The lengths of time that machines were used for Job Nos. 303 and 304 were 200 hours and 750 hours, respectively. The company’s operations department assigned the following job numbers to these orders.

Allocate overhead and executive time to projects.

- If you forget to keep track of such trivial details, you are not able to add their costs to the final invoice.

- It’s important to remember that if subcontractors are hired for specialized tasks beyond your company’s expertise, their costs should be included.

- If you rely on subcontractors to complete work your company doesn’t do itself, factor those costs into your total labor costs for the job.

- Other features such as a GPS time clock make it easy for everyone to clock in and get paid for their time.

This may include reducing the number of employees contracted onto any given job, retraining those who are underperforming, or promoting employees who work more efficiently than others. Identifying and reducing costs to your own business by budgeting and making changes can maximize the amount of revenue you take in, affecting the success of your business in the long term. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Advantages of a Job Cost Sheet

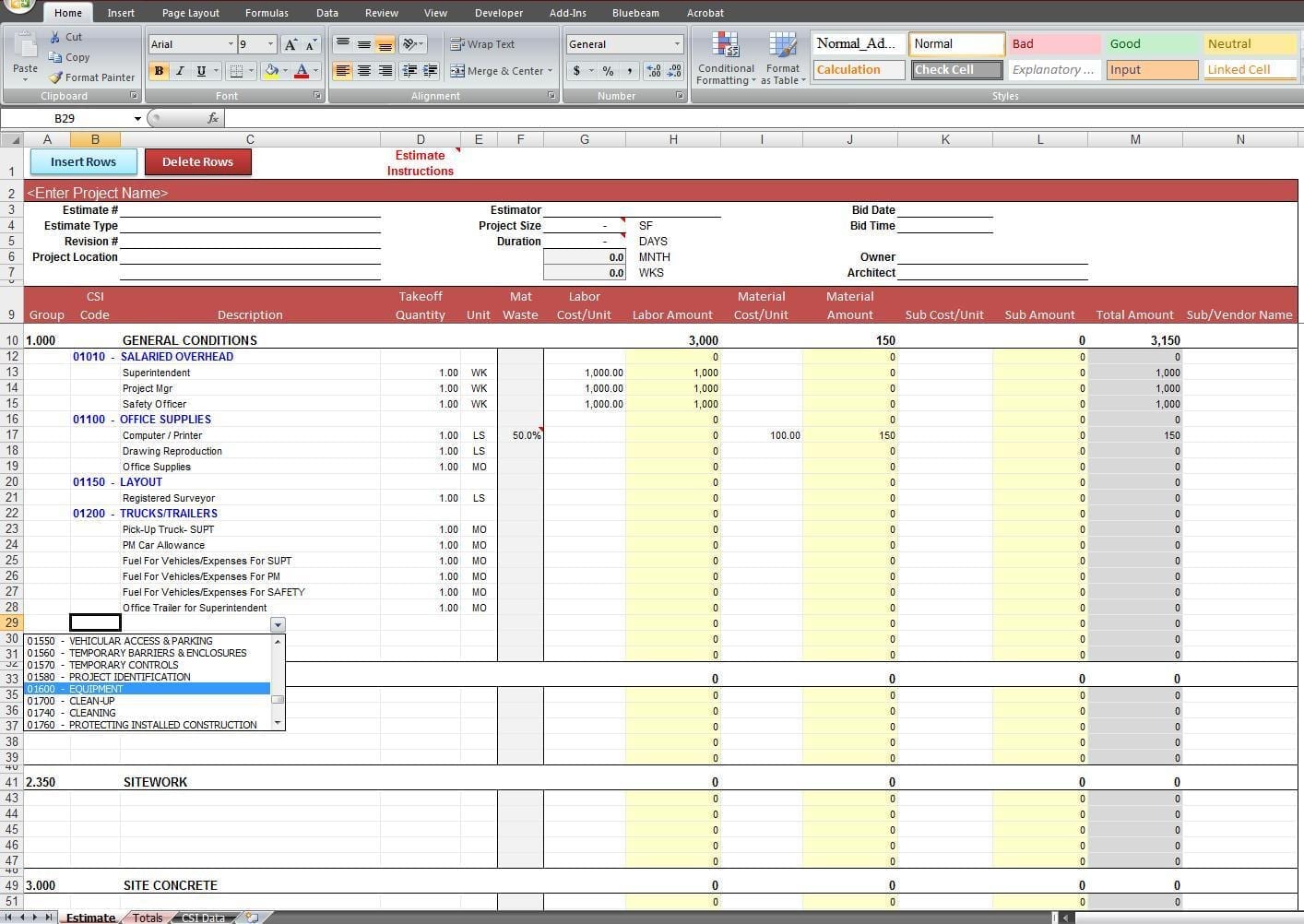

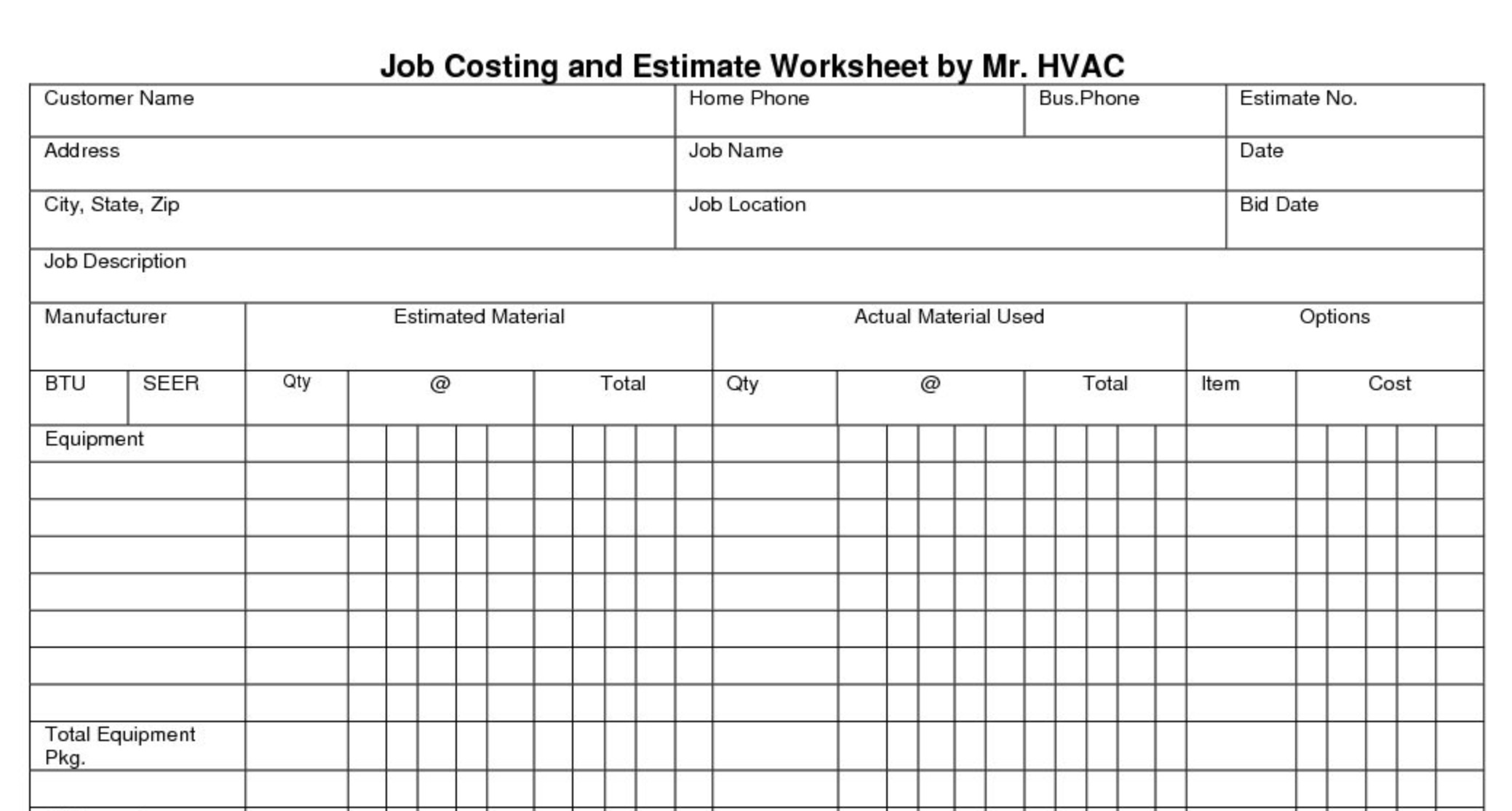

Job costing, also called project-based accounting, is the process of tracking costs and revenue for each individual project. Job costing looks at each project in detail, breaking what is a balance sheet forecast down the costs of labor hours, materials, and overhead. This sample project costing sheet template includes sample text to guide you through the project cost estimation process.

Project Budget Template

This in-depth understanding is enhanced by the use of cash flow projection reports, which are a byproduct of meticulous job costing. For example, if a project accounts for 15% of the company’s total direct costs, it might be allocated 15% of the overhead costs. This method ensures that each project contributes fairly to the company’s overhead, reflecting a more accurate picture of the project’s true cost and profitability. Creating a job cost sheet helps companies stay profitable by taking stock of how much past jobs have cost, allowing business owners to make changes to improve efficiency and reduce costs.

Get Any Financial Question Answered

Job costing provides a granular view of where every dollar is spent in a construction project. This detailed tracking helps identify areas where costs are higher than anticipated, allowing for timely interventions to control spending. Use this simple construction project cost tracking spreadsheet to accurately estimate line-by-line and total construction project costs.

So, if you want to make the most of your resources and take full advantage of automated job cost sheets, sign up for Field Promax. If you are working on a job order that requires multiple projects, you can calculate the total cost individually or divide the total cost by the number of projects to determine the total cost. If this is your first time running or managing a business, you might not be aware of such technicalities. One of the most effective methods of mitigating this risk is to maintain all your costs.

When they’re working with a mixture of full-time and part-time employees, this can be complicated. For example, if you’re building a house, you might need cement, concrete, wood, insulation, etc. Imagine that a lead contacts your contracting company and asks for a quote for the construction of a new house. You’re excited at the new prospect and sit down to come up with a reasonable but competitive quote. If any surplus material is returned from the job to the stores, the job account is given due credit for the value of the same.

It is based on the assumption that manufacturing activities are undertaken to fulfill specific customer orders or contracts. If the overtime premium is fully charged to Job No. 101, the job cost sheet would be prepared as shown below. Process cost is determined by taking the total cost of the project and dividing it by the number of products produced. When creating a new job assignment on Field Promax, you can add your own fields and labels. As a result, you can easily customize the job to reflect real-world names and values. Customization of cast categories inside the system provides complete clarity and transparency, leaving no opportunity for error.

Job costing is the process of determining how much your work will cost you to complete. From there, you can use that figure to price your products and services competitively. Striking the right balance in the level of detail tracked is key for effective job costing. While detailed categorization provides more precise data, excessively granular data can become cumbersome to manage and time consuming to track. The goal is to capture enough detail to inform decision-making without overburdening personnel and the entire system.

This comparison is not just a retrospective look at spending; it’s a critical evaluation of financial performance and profitability. By analyzing how the real-world job costs stack up against the estimator’s predictions, construction firms can gauge the success of their financial planning and execution. In essence, job costing does more than just account for expenses – it provides invaluable insights into the financial health of each project, guiding firms towards more profitable practices. When teams log their hours in the software, management isn’t only getting secure timesheets that streamline the payroll process but another tool to track time and costs. Our timesheets help managers control labor costs and help with project estimates by looking at timesheets from previous projects. Timesheets can automatically log hours and give managers a window into the percentage of tasks their team has completed in real time.